Environmental Alert

(By Lisa M. Bruderly and Evan M. Baylor)

On December 27, 2021, the U.S. Army Corps of Engineers (the Corps) published a final rule reissuing 40 existing Nationwide Permits (NWPs) and issuing one new NWP (Water Reclamation and Reuse Facilities) (86 Fed. Reg. 73522). NWPs authorize certain work in streams, wetlands, and other Waters of the United States under Section 404 of the Clean Water Act and Section 10 of the Rivers and Harbors Act of 1899, when those activities will result in no more than minimal individual and cumulative adverse environmental effects. This final rule rounds out NWP rulemaking activities that began in September 2020, when the Corps, under the Trump administration, proposed to reissue the 52 existing NWPs and issue five new NWPs. Additional NWP revisions are anticipated in 2022.

As background, in January 2021, the Corps modified and reissued 12 of the existing NWPs and issued four of the five proposed NWPs. The January 2021 final rule also revised and reissued the NWP general conditions and definitions. The focus of that rule was largely to revise and reissue NWPs that relate to the energy industry, including the division of existing NWP 12 (Utility Line Activities) into three NWPs, depending on the type of utility line: oil and natural gas pipeline activities (NWP 12), electric utilities and telecommunications (NWP 57), and utility lines for water and other substances (NWP 58).

This December 2021 rule reissues the remaining 40 existing NWPs and issues the one remaining new NWP (NWP 59). The reissuance makes relatively minor changes to several NWPs, including NWP 13 (Bank Stabilization), NWP 27 (Aquatic Habitat Restoration, Enhancement and Establishment Activities), NWP 36 (Boat Ramps), NWP 41 (Reshaping Existing Drainage and Irrigation Ditches), and NWP 53 (Removal of Low-Head Dams). It also states that the NWPs will be subject to the general conditions and definitions included in the January 2021 rule. Previously, these NWPs had been subject to the general conditions and definitions in effect when these NWPs were reissued in 2017.

The rule does not address the 16 NWPs that were finalized in January 2021. The NWPs in this rule replace the 2017 versions of those permits and complete the rulemaking process to reissue the NWPs, which began under President Trump’s administration. These NWPs go into effect on February 25, 2022 and will expire on March 14, 2026, consistent with the expiration date of the NWPs that were reissued in January 2021.

More Changes Expected in 2022

The Biden administration intends to reevaluate the NWPs later this year. According to the Fall 2021 of Regulatory Actions, the Corps is planning a comprehensive rulemaking in 2022 to re-examine all NWPs issued in 2021 “to identify NWPs for reissuance, modification, or issuance, in addition to identifying potential revisions to general conditions and definitions in order to be consistent with Administration policies and priorities.” Changes to the NWP program are expected to undo Trump administration revisions, which, arguably expanded the permits’ applicability, while addressing climate change and environmental justice concerns.

The Corps stated that it is considering whether additional steps should be taken to ensure the NWP program aligns with the Biden administration’s policies and priorities moving forward, including Executive Order 13990, “Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis.” The Order directs agencies to review and act to address regulations from the previous administration that conflict with national objections to improve public health and the environment. Further, the Order directs agencies to prioritize environmental justice. According to Assistant Secretary of the Army for Civil Works, Michael L. Connor, “The [Corps] will also be reviewing the overall NWP program to ensure consistency with the administration’s policies, including the need to engage affected communities.”

The potential revisions to the NWPs, and the impact of these revisions, will undoubtedly be affected by revisions to the definition of Waters of the United States (WOTUS), which are also expected in 2022. The Corps and USEPA published a proposed revision to the WOTUS definition on December 7, 2021 (Rule 1), with the public comment period closing on February 7, 2022. This proposed definition is similar to the pre-2015 definition of WOTUS, with updates to reflect relevant Supreme Court decisions (e.g., Rapanos) that occurred in the early 2000s. The Biden administration intends additional revisions to the WOTUS definition in a second rulemaking (Rule 2). As stated in the Fall 2021 Unified Agenda, “[t]his second rule proposes to include revisions reflecting on additional stakeholder engagement and implementation considerations, scientific developments, and environmental justice values. This effort will also be informed by the experience of implementing the pre-2015 rule, the 2015 Clean Water Rule, and the 2020 Navigable Waters Protection Rule.”

Babst Calland will continue to track developments and changes to the NWP program. If you have any questions about these developments, please contact Lisa Bruderly at 412.394.6495 or lbruderly@babstcalland.com or Evan Baylor at 202.853.3461 or ebaylor@babstcalland.com.

Click here for the PDF.

Infrastructure Alert

(By Jim Curry)

On November 15, President Biden signed the Infrastructure, Investment and Jobs Act (H.R. 3684). This sweeping legislation affects much of the U.S. economy and provides opportunities for state and local governments and their private sector development partners. The Infrastructure Bill will fund repairs and improvements to roads, bridges, tunnels, rail, transit, public water systems, ports, airports, rail, trucking, the electric grid and broadband internet services. It also includes substantial funding for projects and R&D to support advanced energy technologies, and a number of buy-America provisions designed to support domestic industries.

Some of the funding (for example, for highway projects) will go automatically to the states through established formula grant programs, and they will in turn make those funds available to public and private entities for infrastructure project development. In other cases, the bill sets out short deadlines (60, 90 or 180 days, in many cases) for federal agencies to establish programs, set criteria and begin soliciting grants or providing loans. While much of the bill is focused on funding, it also includes important changes in substantive law and expedited permitting designed to promote infrastructure development.

Babst Calland advises its clients on the implications of this and many other federal actions on their businesses. The Firm will provide more detail in the coming months about the Infrastructure Bill. Please contact Jim Curry to explore how your business can leverage the opportunities presented by the Infrastructure Bill.

To view this and other alerts regarding the Infrastructure Bill, click here.

Client Alert

(By Jim Curry, Ashleigh H. Krick, Christopher T. Kuhman)

On November 15, 2021, President Biden signed the bipartisan $1.2 trillion Infrastructure Investment and Jobs Act (H.R. 3684). This Alert reviews the key provisions related to hydrogen and carbon capture, utilization, and storage (CCUS). Babst Calland has also issued a companion Alert on other renewable energy-related provisions in the Infrastructure Bill.

Hydrogen

- Regional Clean Hydrogen Hubs (Sec. 40314): In perhaps the most impactful provision, the Bill authorizes an $8 billion program to support the development of at least four regional clean hydrogen hubs to network hydrogen producers, storage, offtakers and transport infrastructure. DOE must solicit proposals for regional clean hydrogen hubs by May 15, 2022, and select the four hubs by May 15, 2023. DOE will solicit at least one hub proposal for each of the following hydrogen production technologies: fossil fuels, renewables or nuclear. And, DOE will solicit at least one hub to provide hydrogen to each of the following sectors: power generation, industrial, residential and commercial heating, and transportation.

- Clean Hydrogen Definition and Production Qualifications (Secs. 40312 & 40315): Defines “clean hydrogen” and “hydrogen” in a technology neutral way, and requires DOE and EPA to develop an initial carbon standard for projects to qualify as clean hydrogen production, eligible for the variety of incentives throughout the Bill. Clean hydrogen means “hydrogen produced with a carbon intensity equal to or less than 2 kilograms of carbon dioxide (CO2)-equivalent produced at the site of production per kilogram of hydrogen produced.” The standard must consider technological and economic feasibility and allow production from fossil fuels with CCUS, hydrogen carrier fuels, renewables, nuclear and other methods that DOE determines are appropriate.

- Research and Development Program and National Clean Hydrogen Strategy and Roadmap (Secs. 40313 and 40314): Requires DOE to establish an R&D program with the private sector to commercialize clean hydrogen production in a variety of applications by May 15, 2022. This provision includes $500 million in grant funding for clean hydrogen manufacturing and recycling.

- Clean Hydrogen Electrolysis Program (Sec. 40314): Requires DOE to establish a program to improve the efficiency, increase the durability, and reduce the cost of producing clean hydrogen using electrolyzers (commonly called “green hydrogen”) and authorizes $1 billion for grants and demonstration projects. The goal is to reduce the cost of green hydrogen to less than $2 per kilogram by 2026.

- Appalachian Regional Energy Hub (Sec. 14511): Provides the Appalachian Region Commission with $5 million to establish an Appalachian Region hub for natural gas, natural gas liquids, and hydrogen produced through steam methane reforming.

- Grants for Hydrogen Fueling Infrastructure (Sec. 11401): Authorizes the Federal Highway Administration to award $2.5 billion in grants for the acquisition or installation of publicly accessible electric vehicle charging, or hydrogen, propane, or natural gas fueling infrastructure along an alternative fuel corridor.

Carbon Capture, Utilization, and Storage

- Carbon Utilization (Sec. 40302): Requires DOE, through its Carbon Utilization Program, to develop standards to facilitate the commercialization of carbon-based technologies. The Bill also requires DOE to establish a grant program for states and governmental entities to procure and use products that are derived from carbon and reduce greenhouse gas emissions. The Bill authorizes $310 million for this program.

- Carbon Capture Technology (Sec. 40303): Authorizes $100 million for DOE grants under its Carbon Capture Technology Program, including an engineering and design program for CO2 transportation.

- CO2 Transportation Infrastructure Finance and Innovation (Sec. 40304): Creates a CO2 transportation infrastructure finance and innovation (CIFIA) program in DOE and provides $2.7 billion in funding. CIFIA is a federal credit instrument that will provide funding for certain CO2 transportation projects anticipated to cost $100 million or more. In selecting projects, DOE will give priority to large-capacity common carrier pipeline projects, projects with clear demand, and projects sited adjacent to existing pipelines. Grants are also available for upsizing infrastructure to meet increase in future demand. All iron, steel, and manufactured goods used in a project must be produced in the U.S., with some exceptions.

- Carbon Storage Validation and Testing (Sec. 40305): Authorizes $2.5 billion for DOE to provide funding for large-scale carbon sequestration projects and associated transportation infrastructure.

- Secure Geologic Storage Permitting (Sec. 40306): Authorizes $25 million for EPA’s Class VI UIC well permit program for the geologic sequestration of CO2, and $50 million for grants to states seeking Class VI primacy.

- Geologic Carbon Sequestration on the Outer Continental Shelf (Sec. 40307): Allows DOI to grant a lease, easement, or right-of-way on the outer continental shelf for the injection of CO2 into sub-seabed geologic formation, for the purpose of long-term carbon sequestration. The Bill requires DOI to issue regulations by November 15, 2022.

- Carbon Removal (Sec. 40308): Authorizes $3.5 billion for a DOE program to develop four regional air capture hubs. The hubs will facilitate the deployment of direct air capture projects; have the capacity to capture, sequester, or utilize at least one million metric tons of CO2 annually; demonstrate the capture, processing, delivery, and sequestration of captured carbon; and have potential for developing a regional or inter-regional network to facilitate CCUS.

- Carbon Capture Large-Scale Pilot Projects (Sec. 41004(a)): Authorizes $937 million for DOE to carry out a large-scale CCUS technology program.

- Carbon Capture Demonstration Projects Program (Sec. 41004(b)): Authorizes $2 billion for DOE to carry out CCUS demonstration projects.

- Carbon Removal (Sec. 41005). Authorizes $15 million for DOE to award a competitive technology prize for the precommercial capture of CO2 from dilute media and $100 million for commercial applications of direct air capture technologies.

If you have any questions about these developments, please contact Jim Curry at 202.853.3461 or jcurry@babstcalland.com, Ashleigh Krick at 202.853.3466 or akrick@babstcalland.com, or Chris Kuhman at 202.853.3467 or ckuhman@babstcalland.com.

Click here for PDF.

Client Alert

(by Ben Clapp, Anna Jewart and Josh Snyder)

On Monday, November 15, 2021, President Biden signed the Infrastructure Investment and Jobs Act (Infrastructure Bill) into law. The historic $1.2 trillion package contains a number of provisions aimed at promoting the growth of the renewable energy sector and places significant emphasis on large-scale improvements to, and expansion of, the electric transmission grid. Key provisions of the Infrastructure Bill aimed at benefitting the renewables sector are discussed below. Babst Calland is issuing a companion Alert on the Carbon Capture, Utilization, and Storage and Hydrogen Technologies provisions in the Infrastructure Bill.

Transmission Infrastructure Resiliency and Expansion

It is well understood that grid capacity constraints and access to adequate transmission infrastructure are often roadblocks to siting renewable energy projects. The Infrastructure Bill’s investment in transmission infrastructure and resiliency and in building out the grid is designed, in part, to ease these impediments with the aim of making more sites viable for renewable energy development across the country. The Infrastructure Bill allocates about $28 billion to transmission infrastructure generally, including approximately $15 billion in grants and other financial assistance to prevent outages and enhance grid resiliency, develop new or innovative approaches to transmission, storage, and distribution infrastructure, and facilitate siting or upgrading transmission and distribution lines in rural areas.

$2.5 billion is allocated to the “Transmission Facilitation Program,” a fund that allows the Department of Energy (DOE) to enter into a capacity contract for the right to use up to 50 percent of the planned capacity of certain new, expanded or upgraded transmission lines. The program is intended to leverage the DOE investment to demonstrate the project’s viability and thereby encourage other entities to enter into capacity contracts with these transmission projects. The Infrastructure Bill also took steps to reduce certain regulatory barriers which had stalled transmission line development, giving the DOE the authority to designate national transmission corridors to facilitate the deployment of transmission infrastructure in areas with transmission capacity constraints. The provision is designed to enhance the ability of electricity generators, including intermittent producers such as wind and solar projects, to connect to the grid.

Renewable Energy Technology Investments

In addition to investing in the modernization and expansion of the transmission grid, the Infrastructure Bill allocates significant funding towards the development of renewable energy and energy storage technologies.

Solar and Wind

The Infrastructure Bill promotes the development of solar projects on current or former mine land, requiring the DOE to create a report of the viability of siting solar energy on those lands, including the necessary interconnection, transmission siting, and impacts on local job creation. $500 million is authorized for the creation of a DOE program to demonstrate the technical and economic viability of carrying out clean energy projects on current and former mine land. Up to five qualifying projects will be selected to receive financial assistance based on a project’s capacity to create jobs and reduce or avoid greenhouse gas emissions.

In addition to the mine land-specific provisions, $80 million is allocated to the DOE for programs established under the Energy Act of 2020 to provide grants and other financial assistance to promote the development and commercialization of solar energy technologies. $100 million is allocated to the DOE for similar wind programs.

Investment in Energy Storage Development

The Infrastructure Bill appropriates $505 million to the DOE to carry out energy storage initiatives previously authorized under the Energy Act of 2020. $355 million is allocated to a competitive grant program to advance energy storage technologies. $150 million is allocated to the DOE for its long-duration energy storage technologies program. A Battery Material Processing Grant Program is created to expand the capabilities of the United States in advanced battery manufacturing. The DOE will award grants for (i) demonstration projects for the processing of battery materials; (ii) construction of commercial-scale battery material processing facilities; and (iii) projects to retool, retrofit, or expand existing battery material processing facilities.

Supply Chains for Renewable Technology

The Infrastructure Bill includes several provisions that aim to help alleviate supply chain issues that affect the renewable energy sector. Rare-earth elements are key raw materials for components of solar and wind power equipment. The United States is currently dependent on other countries to supply these important resources. $320 million is allocated to the Earth Mapping Resources Initiative (Earth MRI). The Earth MRI maps mineral deposits (including rare-earth elements) within the United States. Another $307 million is provided to fund research related to the extraction, reclamation, and refining of rare-earth elements, and to demonstrate the commercial feasibility of a full-scale, integrated rare-earth extraction and separation facility and refinery.

Conclusion

The Infrastructure Bill is a sweeping piece of legislation in which provisions related to the promotion of renewables development are a relatively small component. Nonetheless, renewable energy proponents are hopeful that the provisions discussed in this Alert will help the sector continue the explosive rate of growth that it has enjoyed in recent years by unclogging the transmission bottleneck and incentivizing investment in new technologies.

The Infrastructure Bill provides the agencies tasked with implementing it a large amount of discretion in developing and managing its programs. Babst Calland will be monitoring the ensuing regulations and guidance issued by those agencies closely as they work to bring the Infrastructure Bill’s goals to fruition. If you have any questions about the developments described in this Alert, please contact Ben Clapp at 202.853.3488 or bclapp@babstcalland.com; Joshua Snyder at 412.394.6556 or jsnyder@bcalland.com; or Anna Jewart at 412.253.8806 or ajewart@babstcalland.com.

Click here for PDF.

Environmental Alert

(By Sean M. McGovern and Evan M. Baylor)

On October 28, 2021, Governor Tom Wolf issued an Executive Order (Order) addressing environmental justice in the Commonwealth (Executive Order 2021-07). In support of the Order, Pennsylvania legislators announced environmental justice actions that would reflect the directives of the Order.

Executive Order

Gov. Wolf’s Order largely focuses on the establishment of bodies within the Department of Environmental Protection (DEP) and an interagency council within the Executive Branch to better address environmental justice, which is addressed in further detail below. The Order also asserts:

- The Commonwealth’s duty to “ensure the rights and duties of Article I, Section 27 protect all the people of Pennsylvania” and the significance of environmental justice in President Biden’s Executive Order 14008 and his administration’s mission;

- That low-income communities and communities of color residents bear a disproportionate share of adverse climate and environmental impacts with accompanying adverse health impacts; and

- That all Pennsylvanians are entitled to meaningful involvement in decision-making that impacts their lives, environments, and health and that such involvement is critical to reduce adverse impacts.

Environmental Justice Advisory Board

The Order formally established the existing Environmental Justice Advisory Board (EJAB). The EJAB makes recommendations to the DEP Secretary concerning environmental justice policies, practices, and actions. The EJAB shall meet at least semi-annually.

Office of Environmental Justice

The Order formally establishes the existing Office of Environment Justice (OEJ) within the DEP. In 2002, the DEP established the Office of Environmental Advocate. In 2015, the DEP renamed the Office of the Environmental Advocate as the Office of Environmental Justice. The OEJ acts as a point of contact for residents in low-income areas and areas with a higher number of minorities. The primary goal of the OEJ is to increase communities’ environmental awareness and involvement in the DEP permitting process. While the office is not newly established, the Order includes some notable new roles and responsibilities for the OEJ.

The Order directs the OEJ to develop and publish an environmental justice strategic plan (EJ Plan) every five (5) years. The EJ Plan should include recommendations for advancing environmental justice, focusing attention on the environmental and public health issues and challenges confronting the Commonwealth’s minority and low-income populations. The plan should also make recommendations on the integration of Environmental Justice considerations into existing DEP programs.

The Order further directs the OEJ to revise the Enhanced Public Participation Policy (EJ Policy). The Order suggests a revised EJ Policy should include the definitions of “Environmental Justice Area,” “cumulative environmental impacts,” and “disproportionate environmental impacts.” The Policy should include established criteria for Environmental Justice Areas. Importantly, the EJ Policy should include standardized mitigation and/or restoration practices for consideration by applicants and permit application reviewers in the permitting or cleanup context. This requirement may result in the development of standards or best management practices, where none previously existed, for mitigation and restoration practices. The DEP is currently working to update the EJ Policy and earlier this year released a working draft of the revised EJ Policy. It is anticipated that a revised EJ Policy will be released for public comment in the coming months. Following the DEP’s response to those comments and subsequent changes to the EJ Policy as a result of that input, the DEP has signaled that it intends to finalize the revised EJ Policy as early as the spring of 2022. The Order does not dictate a timeline for DEP to finalize a revised policy.

Environmental Justice Interagency Council (EJIC)

The Order establishes the Environmental Justice Interagency Council (EJIC). This new body will require coordination between executive agencies to comprehensively address environmental justice. This new body shall consist of the Secretaries (or their designees) of Conservation and Natural Resources, Education, Agriculture, Health, Transportation, Community and Economic Development, as well as cabinet members or agency heads as determined by the governor. The EJIC will advise the governor’s office and executive agencies, review the environmental justice strategic plan, ensure Commonwealth consistency with federal environmental justice programs, and recommend an environmental justice training plan for all executive agencies. Further, each executive agency included in the EJIC shall develop a strategic plan every five years to promote Environmental Justice, in accordance with each agency’s authority, mission, and programs. The EJIC will meet within 90 days of October 28, 2021, and at least semi-annually going forward.

Pending Legislative Action

In concert with Gov. Wolf’s Order, two proposals are now moving through the legislature. On October 26, 2021, Representative Donna Bullock (D-Philadelphia) proposed a resolution recognizing the 30th anniversary of the adoption of the 17 principles of Environmental Justice that were presented to delegates at the First National People of Color Environmental Leadership Summit (Resolution 151). And earlier this year, Senator Vincent Hughes (D-Philadelphia) proposed a bill echoing Gov. Wolf’s Order (Senate Bill 189). The bill proposes to permanently establish the OEJ and the EJAB. Additionally, the bill proposes to establish an Environmental Justice Task Force and Regional Environmental Justice Committees.

According to the bill, the OEJ would be charged with the creation of an EJ Task Force (Task Force). The Task Force would plan a strategy and develop guidelines for the operation of new Regional Environmental Justice Committees (Regional EJ Committees), which would provide an avenue for residents to raise environment justice concerns. Municipalities or residents would be able to file a petition directly with a Regional Environmental Justice Committee regarding adverse exposure to environmental health risks or to disproportionate adverse effects resulting from the implementation of a state law, regulation, guideline or policy affecting public health or the environment. A petition would trigger an initial review by the Regional EJ Committee and a public meeting with the relevant municipality to discuss the petition. Within 120 days of the public meeting, the Task Force would be required to issue an action plan to address the petition.

What’s Next?

As the DEP continues to work on revisions to the current EJ Policy, they will certainly look to include revisions as directed by the Order into their working draft. In their May 2021 meeting the EJAB discussed updates to the proposed EJ Policy and the EJ Policy will be discussed again at their next meeting on November 16, 2021 (Agenda). Further, the EJAB will also discuss the Order and meet with a representative of the Office of the Attorney General to discuss environmental justice at their next meeting.

Babst Calland will be tracking the revisions to the EJ Policy and subsequent actions taken in response to Gov. Wolf’s Order. If you have any questions about the environmental justice developments described in this Alert, please contact Sean McGovern at 412-394-5439 or smcgovern@babstcalland.com or Evan Baylor at 202-868-0538 or ebaylor@babstcalland.com.

Click here for the PDF.

Energy Alert

(by Timothy Miller, Jennifer Hicks and Katrina Bowers)

The West Virginia Supreme Court of Appeals has accepted four questions certified to it by The United States District Court for the Northern District of West Virginia in Charles Kellam, et al. v. SWN Production Company, LLC, et al., No. 5:20-CV-85. The Court will hear oral argument during the January 2022 term. The Court will address four questions: (1) Is Estate of Tawney v. Columbia Natural Resources, LLC, 219 W.Va. 266, 633 S.E.2d 22 (2006) (Tawney) still good law in West Virginia; (2) What is meant by the “method of calculating” the amount of post-production costs to be deducted; (3) Is a simple listing of the types of costs which may be deducted sufficient to satisfy Tawney; and (4) If post-production costs are to be deducted, are they limited to direct costs or may indirect costs be deducted as well?

At the time of the District Court’s certification in Kellam, defendants’ Motion for Judgment on the Pleadings asserting that the Kellams’ lease complied with Tawney and that the District Court was bound by the decision in Young v. Equinor USA Onshore Properties, Inc., 982 F.3d 201 (4th Cir. 2020) was pending. In Young, the 4th Circuit Court of Appeals reversed Judge Bailey and held the lease clearly and unambiguously allowed the deduction of post-production expenses and noted that “Tawney doesn’t demand that an oil and gas lease set out an Einsteinian proof for calculating post-production costs. By its plain language, the case merely requires that an oil and gas lease that expressly allocates some post-production costs to the lessor identify which costs and how much of those costs will be deducted from the lessor’s royalties.” Young, 982 F.3d at 208. Moreover, the 4th Circuit noted recent criticism of Tawney by the West Virginia Supreme Court of Appeals. See Leggett v. EQT Prod. Co., 239 W. Va. 264, 800 S.E.2d 850 (2017).

For more information about the case, contact Tim Miller at 681.265.1361 or tmiller@babstcalland.com, Jennifer Hicks at 681.265.1370 or jhicks@babstcalland.com, or Katrina Bowers at 681.205.8955 or kbowers@babstcalland.com, who are serving as counsel for the defendants in Kellam.

Click here for PDF.

Pipeline Safety Alert

(by Keith Coyle, Jim Curry and Brianne Kurdock)

On November 2, 2021, the Pipeline and Hazardous Materials Safety Administration (PHMSA) released a pre-publication version of its final rule for onshore gas gathering lines. The final rule, which represents the culmination of a decade-long rulemaking process, amends 49 C.F.R. Parts 191 and 192 by establishing new safety standards and reporting requirements for previously unregulated onshore gas gathering lines. Building on PHMSA’s existing two-tiered, risk-based regime for regulated onshore gas gathering lines (Type A and Type B), the final rule creates:

- A new category of onshore gas gathering lines that are only subject to incident and annual reporting requirements (Type R); and

- Another new category of regulated onshore gas gathering lines in rural, Class 1 locations that are subject to certain Part 191 reporting and registration requirements and Part 192 safety standards (Type C).

The final rule largely retains PHMSA’s existing definitions for onshore gas gathering lines but imposes a 10-mile limitation on the use of the incidental gathering provision. The final rule also creates a process for authorizing the use of composite materials in Type C lines and prescribes compliance deadlines for Type R and Type C lines. Additional information about these requirements is provided below.

Type R Lines

The final rule creates a new category of reporting-only regulated gathering lines. These gathering lines, known as Type R lines, include any onshore gas gathering lines in Class 1 or Class 2 locations that do not meet the definition of a Type A, Type B, or Type C line. Operators of Type R lines must comply with the certain incident and annual reporting requirements in Part 191. No other requirements in Part 191 apply to Type R lines.

Type C Lines

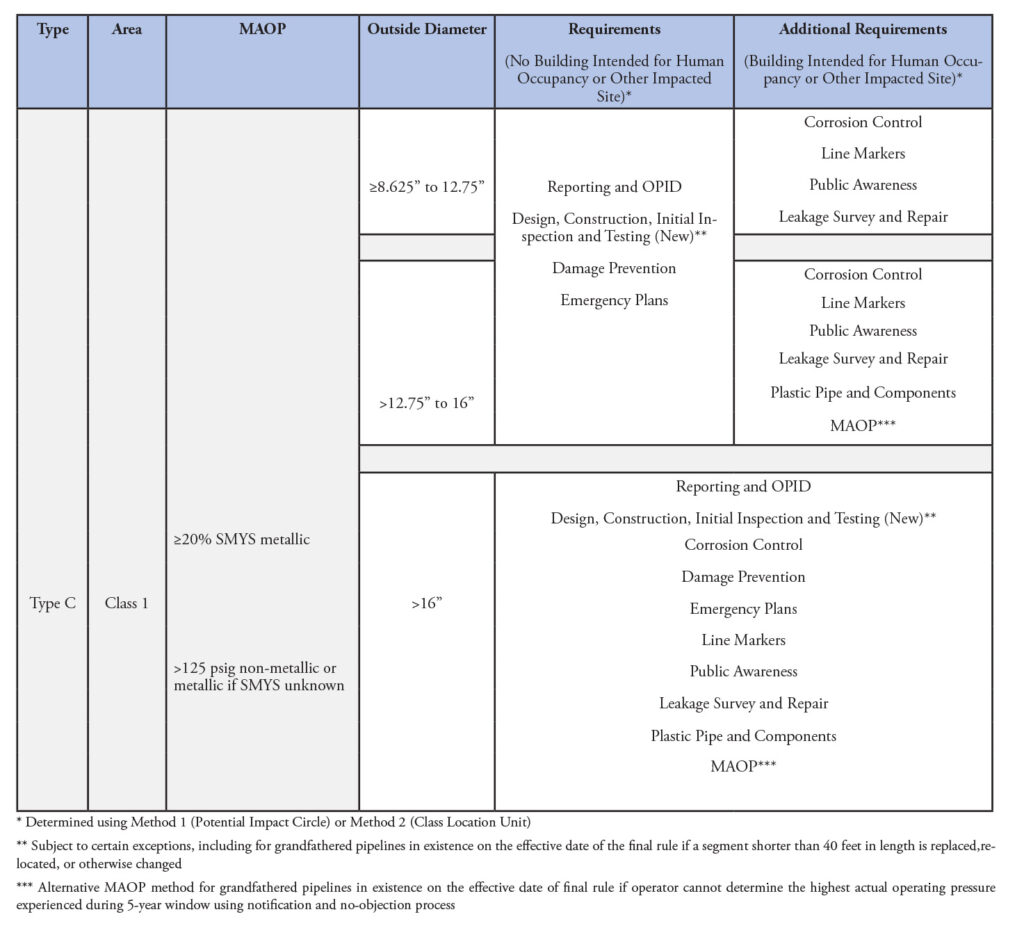

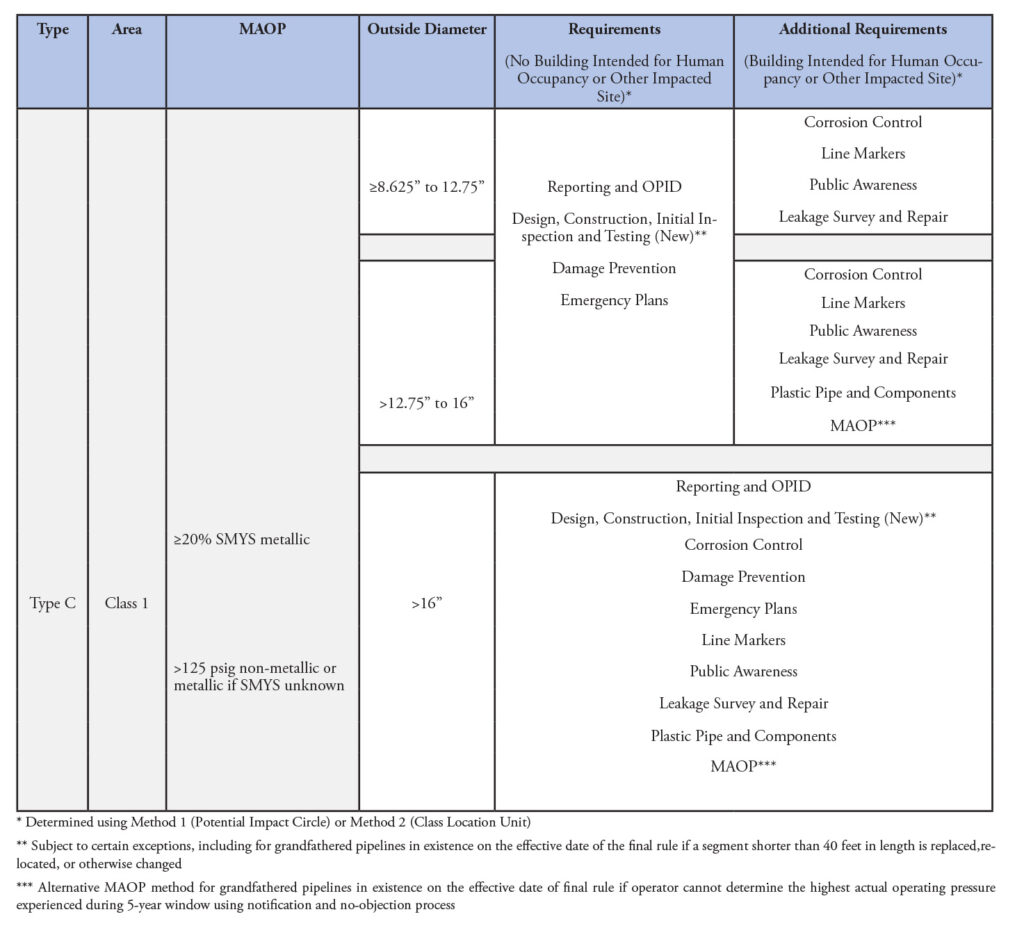

The final rule creates a new category of regulated onshore gas gathering lines. These gathering lines, known as Type C lines, include onshore gas gathering lines in rural, Class 1 locations with an outside diameter greater than or equal to 8.625 inches and a maximum allowable operating pressure (MAOP) that produces a hoop stress of 20 percent or more of specified minimum yield strength (SMYS) for metallic lines, or more than 125 psig for non-metallic lines or metallic lines if the stress level is unknown.

Operators of Type C lines are subject to the same Part 191 requirements as Type A and Type B lines and must comply with certain Part 192 requirements for gas transmission lines, subject to the non-retroactivity provision for design, construction, initial inspection, and testing, as well as other exceptions and limitations that vary based on the outside diameter of the pipeline and whether there are any buildings intended for human occupancy or other impacted sites within the potential impact circle or class location unit for a segment. The final rule also provides additional exceptions from certain requirements, including for grandfathered pipelines if a segment 40 feet or shorter in length is replaced, relocated, or otherwise changed. A chart illustrating the applicable requirements is provided below.

In addition to prescribing these new requirements, the final rule authorizes the use of composite materials in Type C lines if the operator provides PHMSA with a notification containing certain information at least 90 days prior to installation or replacement and receives a no-objection letter or no response from PHMSA within 90 days.

Deadlines

The effective date of the final rule is 6 months after the date of publication in the Federal Register. Operators of Type R and Type C lines must comply with the applicable requirements in Part 191 starting as of the effective date, although the first annual report is not due until March 15, 2023. Operators must also comply with the requirement to document the methodology used in determining the beginning and endpoints of onshore gas gathering within 6 months of the effective date, and operators of Type C lines must comply with the applicable requirements in Part 192 within 12 months of the effective date. Operators may request an alternative to these 6- and 12-month compliance deadlines by providing PHMSA with a notification containing certain information at least 90 days in advance and receiving a no-objection letter or no response from PHMSA within 90 days.

Other Considerations

In accordance with 49 C.F.R. § 190.335, administrative petitions for reconsideration must be filed with PHMSA within 30 days of the final rule’s publication in the Federal Register. Petitions for judicial review must be filed within 89 days of the final rule’s publication in the Federal Register or, if an administrative petition for reconsideration is filed, within 89 days of PHMSA’s decision on the petition.

For a more detailed assessment or to discuss the implications of the Final Rule, please contact Keith Coyle at 202.853.3460 or

KCoyle@babstcalland.com, Jim Curry at 202.853.3461 or JCurry@babstcalland.com, or Brianne Kurdock at 202.853.3462 or

BKurdock@babstcalland.com.

Click here for PDF.

Smart Business

(by Sue Ostrowski featuring Moore Capito)

For years, the banking industry has functioned in the same ways it always has. But FinTech — financial technology — is revolutionizing the way things are done and increasing access to financial tools for those who may not have previously had it.

“At its core, FinTech is when you have the convergence of an emerging technology and a financial service,” says Moore Capito, shareholder at Babst Calland. “It’s using innovation to compete with traditional methods of delivering financial services.”

Smart Business spoke with Capito about how FinTech is revolutionizing the financial industry, the opportunities it presents and challenges it poses.

How is Fintech Changing the Financial Industry?

There are a lot of unbanked, or underbanked, people that have difficulty accessing the traditional banking industry. FinTech products, sometimes in collaboration with a traditional bank, can provide better financial services to these individuals, especially in rural areas where there is less access to bricks-and-mortar banks.

There are potentially endless applications, from insurance to mobile banking, cryptocurrency, investment apps, and financial products including mortgages — the most well-known being PayPal. The onset of COVID accelerated the necessity and the willingness to adapt with FinTech, doing more transactions remotely from phones and bringing finance directly to individuals, instead of individuals going to a physical banking location.

On the economic development side, entrepreneurs are coding programs that create the functionality behind the apps. And states such as West Virginia have created regulatory sandboxes for FinTech entrepreneurs. These let participants apply to come in and test their products in the marketplace without going the traditional regulatory route, allowing them to become viable and ready for commercialization before becoming regulated by state agencies. It gives them two years to be able to exist with greater leniency and more flexibility, to be leaner and nimbler to develop their products.

What are the Challenges of Fintech?

Traditional finance wants to protect itself against changes to how it operates, which can be a challenge. In a lot of states, the banking industry is slow to move. It’s a conservative industry, and it is hesitant to accept change. It has resisted for a long time because emerging technology can be disruptive.

However, we need to be engaging with startup businesses that are innovating. We are living in a changing market, and we need to lean into these changes that are not only moving the industry forward but that are creating jobs. Disruption can be scary for big, entrenched industries. But while it can be intimidating, rising tides lift all ships and everyone becomes better as a result.

The second challenge is to ensure the consumer is protected. By their very nature, some startups fail, and we need to ensure no consumers are hurt in cases where a business doesn’t get off the ground.

What Does the Future of Fintech Look Like?

It’s unbelievable how quickly it’s continuing to grow. Even with a recent downturn in the economy, we’ve seen increased investment; the venture capital community is investing billions of dollars in a year where there has been quite a bit of handwringing. While technology and disruption can be scary, these products, once tested and trusted, create conveniences that are making people’s financial lives happier and healthier.

The entrepreneurial community in the FinTech space is very vibrant, and they are attracted to places that want them. We have created a very welcoming and forward-thinking space for entrepreneurs that only not serves the state and the wider region, but that also has a global impact.

For full article, click here.

For the PDF, click here.

Environmental Alert

(by Matt Wood and Mackenize Moyer)

On October 18, 2021, the U.S. Environmental Protection Agency (EPA) released its comprehensive strategy for addressing per- and polyfluoroalkyl substances (PFAS), “PFAS Strategic Roadmap: EPA’s Commitments to Action 2021–2024” (Roadmap). PFAS are a large group of manmade chemicals that have been widely used in various consumer, commercial, and industrial applications since the around 1940s and more recently have been discovered in environmental media (e.g., groundwater), as well as in plants, animals, and humans. PFAS do not tend to break down naturally, and evidence suggests that exposure to PFAS can lead to adverse health effects. As such, the EPA Council on PFAS, established by EPA Administrator Michael S. Regan in April 2021, developed the Roadmap to “pursue a rigorous scientific agenda to better characterize toxicities, understand exposure pathways, and identify new methods to avert and remediate PFAS pollution.”[1]

The Roadmap highlights EPA’s “whole-of-agency” approach, that includes proposed actions across program offices, as well as the PFAS “lifecycle” (i.e., activities that occur prior to PFAS entering the environment, such as manufacturing). EPA’s “Key Actions” illustrate this approach and are informed by one or more of the Roadmap’s three central directives: (1) Research; (2) Restrict; and (3) Remediate. A selection of the Roadmap’s Key Actions is summarized below.

Office of Water

- Establish a National Primary Drinking Water Regulation (NPDWR) for PFOA and PFOS – In March 2021, EPA published the Fourth Regulatory Determinations, which included a final determination to regulate PFOA and PFOS in drinking water. EPA expects to issue a proposed NPDWR for PFOA and PFOS in fall 2022. A final regulation is anticipated in fall 2023.

- Reduce PFAS Discharges through NPDES Permitting – EPA is seeking to use existing NPDES authorities to reduce PFAS discharges at the source. Proposals include monitoring requirements at facilities where PFAS are expected or suspected to be present in wastewater and stormwater discharges and issuing new state permitting guidance. These proposals are expected winter 2022.

- Restrict PFAS Discharges from Industrial Sources through a Multi-Faceted Effluent Limitations Guidelines (ELG) Program – By 2024, EPA plans to make significant progress in its ELG regulatory work by addressing PFAS from specific industrial sources. As examples, EPA intends to: (1) Develop rules to restrict PFAS discharges from industrial categories, where existing data support it (e.g., plastics and synthetic fibers); (2) Study facilities where EPA has preliminary data on PFAS discharges (e.g., electronic components); and (3) Complete data reviews for industrial categories for which there is little known information on PFAS discharges (e.g., plastics molding and forming).

- Finalize Risk Assessment for PFOA and PFOS in Biosolids – By winter 2024, EPA intends to complete a risk assessment to determine whether to regulate PFOA and PFOS in biosolids.

Office of Air and Radiation

- Build Technical Foundation to Address PFAS Air Emissions – No PFAS compounds are currently listed as hazardous air pollutants (HAPs), but EPA is building the technical foundation to inform future decisions, e.g., identifying sources of PFAS air emissions; developing and finalizing monitoring approaches for measuring stack emissions and ambient concentrations of PFAS; and developing information on cost-effective mitigation technologies. EPA expects to evaluate mitigation options, including listing certain PFAS as HAPs and/or pursuing other regulatory and non-regulatory approaches, by fall 2022.

Office of Land Emergency and Management

- Designate PFOA and PFOS as CERCLA Hazardous Substances – EPA intends to publish a proposed rule to designate PFOA and PFOS as CERCLA hazardous substances in spring 2022 (with a final rule expected summer 2023). These designations would require facilities to report PFOA and PFOS releases above applicable reportable quantities and allow EPA to use additional enforcement and cost recovery authority, including potentially “reopening” previously remediated Superfund sites.

- Issue Advance Notice of Proposed Rulemaking (ANPR) for Various PFAS under CERCLA – EPA expects to issue an ANPR in spring 2022 to propose designating other PFAS as hazardous substances under CERCLA and to seek input on designating precursors, additional PFAS, and groups or subgroups of PFAS.

Office of Chemical Safety and Pollution Prevention

- Develop National PFAS Testing Strategy – EPA is developing a national PFAS testing strategy to address data gaps regarding PFAS toxicity and better understand potential hazards from categories of PFAS (most PFAS have little or no toxicity data). EPA intends to use its TSCA authority to require PFAS manufacturers to fund and conduct additional studies, with the first round of test orders on selected PFAS expected to be issued by the end of 2021.

Cross-Program Actions, Public Engagement, and Other Developments

In addition to individual programmatic actions, EPA’s “whole-of-agency” approach includes collaboration between EPA offices, utilizing enforcement tools from multiple environmental authorities (e.g., RCRA, CERCLA, the Clean Water Act, and TSCA), to identify and address past and ongoing PFAS releases from various sources. These tools include, among other things, conducting inspections, collecting data, and issuing information requests, as well as addressing or limiting future releases, and likely will expand in the coming years. At the recommendation of the National Environmental Justice Advisory Council, EPA will also directly engage with communities in all EPA Regions to understand the impacts of PFAS contamination on their lives – experiences EPA will rely on to inform the actions summarized in the Roadmap. Similarly, EPA has identified developing meaningful educational materials as an important tool to assist the broader public in understanding PFAS and their potential risks. To keep stakeholders informed, EPA will report annually on its progress implementing the Roadmap’s actions.

Recent developments indicate that EPA aims to move swiftly to accomplish its goals. One week after releasing the Roadmap, EPA announced that it had finalized a human health toxicity assessment for GenX chemicals (a subset of PFAS), which the agency identified in the Roadmap as a fall 2021 goal. The finalized assessment represents a preliminary step toward developing health advisory levels (HALs) for GenX under the Safe Drinking Water Act, an action that EPA expects to complete in spring 2022. Although HALs are informational in nature (i.e., they are non-regulatory and non-enforceable), their development could be an interim step toward EPA establishing NPDWRs for GenX chemicals.

On October 26, 2021, in response to a petition from New Mexico Governor Michelle Lujan Grisham, EPA Administrator Regan announced that EPA plans to initiate two rulemakings to address PFAS. Under the first rulemaking, EPA will propose adding four PFAS as RCRA Hazardous Constituents, PFOA, PFOS, PFBS, and GenX, making them subject to corrective action requirements (such a designation would also inform future efforts to regulate PFAS as a listed hazardous waste). The second proposed rulemaking, related to the first, will clarify in applicable regulations that emerging contaminants such as PFAS (that meet the statutory definition of hazardous waste) can be cleaned up via the RCRA corrective action process. EPA Administrator Regan specifically highlighted these proposed rulemakings as part of EPA’s broader strategy to address PFAS contamination.

Conclusion

The Roadmap represents EPA’s broadest strategy to address PFAS since the agency released its 2019 PFAS Action Plan. That is, it sets specific timeframes to accomplish a range of identified actions that span multiple EPA offices, various statutory and regulatory programs, and the “lifecycle” of PFAS. Moreover, as many of EPA’s actions represent preliminary or interim steps in their respective regulatory processes, and as EPA continues to gather data on PFAS, stakeholders likely can expect the Roadmap to evolve over time as EPA accomplishes its goals (e.g., EPA may add new, future actions).

Despite the speed at which EPA and the Biden administration appear to be moving to address PFAS, many states have developed (or are currently developing) their own applicable regulations. For example, in recent years, New Jersey set maximum contaminant levels (MCLs) in drinking water for PFOA, PFOS, and PFNA, and designated all three compounds as hazardous substances under state law. In Pennsylvania, the Department of Environmental Protection is in the process of proposing MCLs in drinking water for PFOA and PFOS. In short, while EPA implements its strategy over the coming months and years, relevant parties in many states have been (or will be) operating under applicable state regulations. The Roadmap and related materials are available on EPA’s website here.

Babst Calland will continue to track EPA’s proposed actions (and other developments, e.g., at the state level) and are available to assist you with PFAS-related matters. For more information for this or other remediation matters, please contact Matthew C. Wood at (412) 394-6583 or mwood@babstcalland.com, Mackenzie Moyer at (412) 394-6578 or mmoyer@babstcalland.com, or any of our other environmental attorneys.

_____________

[1] PFAS Strategic Roadmap: EPA’s Commitments to Action 2021–2024, 6.

Click here for PDF.

Pittsburgh Business Times

(by Daniel Bates featuring Keith Coyle and Blaine A. Lucas)

Even as opposition grows for energy pipelines, and government agencies toughen their regulation of the industry, pipelines remain the most safe, efficient and effective means to transport much-needed natural gas and other energy products from wells to end users to generate power, manufacture goods and heat homes.

So said Keith Coyle, a shareholder with law firm Babst Calland whose practice areas include energy law and pipeline and hazmat safety.

“We’re in a moment right now where we’re seeing some growing opposition to natural gas pipeline infrastructure,” Coyle said in making his case for the importance of supporting and protecting the nation’s energy pipeline infrastructure. “We’re seeing efforts to encourage governmental authorities to ban the construction of new pipelines or to delay the issuance of permits that are necessary for projects to move forward. We’re also seeing litigation that’s being used as a tool to try to block new pipelines or stop the operation of existing pipelines.”

Coyle and his colleague, Babst Calland shareholder Blaine Lucas, took their stand in favor of safe and efficient pipeline infrastructure as part of a recent discussion with the Pittsburgh Business Times on “The Challenges and Opportunities for the Pennsylvania Gas Pipeline Industry.”

Coyle and Lucas are quick to suggest that the current political climate, as well as the growing opposition from environmental activists and others, are problematic not just for the energy industry, but for people, the economy – and safety.

“One of the things that concerns me is if we remove pipelines from the equation, everything about the energy transportation network becomes less safe,” Coyle said. “You’ll end up encouraging the use of other forms of transportation to move gas and other energy products to market, and those other forms of transportation are not as safe as pipelines.

“The other thing we need to think about is who’s going to be impacted if pipelines are unavailable to move products,” he continued. “In a lot of cases, the people who are most affected are those who are the most in need. We’re talking about people who can be really harmed if energy is not safely and reliably available.”

Coyle cited the situation this past year in Texas, when a series of unexpected storms left parts of the state without a sufficient supply of power for a prolonged period and challenged the state’s energy infrastructure going forward.

“Think about what happened in Texas earlier this year during a brief energy crisis,” he said. “People lost their lives. It was a very difficult and challenging event we’re still trying to unwind. Then think about what happened in Texas and expand that on a broader scale if we’re not able to move energy to market. Customers aren’t able to turn their lights on. Hospitals aren’t able to operate. That’s what’s concerning to me for the long term.”

Such challenges hit home, Coyle said, because of Pennsylvania’s leading role in providing such energy to much of the country via pipelines.

“Pennsylvania plays such a critical role in meeting seasonal changes in energy demand,” he said.

Safest mode of gas transportation

For Pennsylvania, energy pipelines are, as Coyle said, “extremely, extremely important.” He noted that Pennsylvania is one of the country’s leading exporters of energy to other states, largely via a network of pipeline infrastructure – trailing only Texas and Wyoming.

“Most of the country’s natural gas is transported by pipelines, and that’s because pipelines are just the safest and most efficient way of moving energy products,” Coyle said.

In 2019, he said, there were an estimated 38,000 transportation-related fatalities in the United States – but only 12 involving pipelines, according to the Bureau of Transportation Statistics. And of an estimated 2.7 million transportation-related injuries that occurred in 2018, only 81 of those injuries involved pipelines.

“If you look at the data and statistics, what you’ll see is pretty clear: pipelines are extremely safe, and they’re necessary to move products from where they’re produced to end-users,” Coyle said. “And if we didn’t have pipelines, quite frankly, Pennsylvanians and the rest of the country would be a lot less safe than they are today.”

Pipeline primer

To understand what’s at stake for the energy industry and end-users in the pipeline debate, Coyle discussed what he described as four key types of pipelines that make up the country’s energy infrastructure. First are the production pipelines, which tend to be located near the well heads that are extracting the gas from the ground.

“These pipelines don’t usually extend a very long distance, and they’re basically used to move gas from the area where it’s produced to the connection with another pipeline, typically a gathering line,” Coyle explained. “One of the things about production lines is the gas that they carry generally is not suitable for transportation to consumers or even transportation for a great distance.”

Instead, the raw gas is transported to so-called gathering pipelines, which collect the raw gas from various sources and transport it to processing plants, compressor stations and treatment facilities for refinement into “pipeline-quality” gas, he continued.

Third are transmission lines. “They tend to be long-haul pipelines carrying gas that is pipeline-quality, suitable for end use,” Coyle said. “Transmission lines tend to be larger-diameter, higher-pressure lines, bigger lines. The reason for that is we use transmission lines to move gas efficiently and effectively across Pennsylvania and throughout the United States from the areas where gas is produced to the areas where the gas is consumed.”

The fourth type – “probably the one most people are more familiar with – is the distribution line, a smaller, lower-pressure line that transports gas to the end-user, whether residential or commercial.”

Regulatory challenges ahead

As the energy transportation industry continues to grow and evolve and as environmental activists continue to put more pressure on regulators to curtail transportation activities, the energy sector can expect tighter regulation ahead from key federal and state agencies, including the Pipeline and Hazardous Materials Safety Administration (PHMSA), Federal Energy Regulatory Commission (FERC) and the Pennsylvania Public Utility Commission (PAPUC) – some warranted and some more politically motivated, both Babst Calland attorneys agree.

Coyle said a move already is afoot to create new regulatory rules for the oversight of gathering lines, which are becoming larger, with higher pressures. Leading that charge is the federal Pipeline and Hazardous Materials Safety Administration, or PHMSA, which prescribes and enforces safety standards for gas pipelines. Current rules apply mainly to all transmission and distribution pipelines, as well as some gas gathering lines.

“We’ve seen changes in the midstream sector that are driving regulators like PHMSA to reevaluate some of the judgments that they’ve made about the safety of gas gathering lines [which tend to be located in rural areas with sparse populations],” Coyle said. “One of the things we’re seeing as a result of shale gas development is some larger-diameter, higher-pressure gathering lines that are moving larger volumes of gas that is produced at the well head to the central collection points. When you have larger-diameter, higher-pressure pipelines, you have more potential risk to public safety.”

Consequently, PHMSA has been working on a new rule to “extend safety standards and reporting requirements to these rural lines,” he said. “The last time I checked, the rule was over at the Office of Management and Budget for review…We expect OMB to complete its review maybe later this year, and we may see a final rule that’s published either at the end of this year or early next year.”

As such, Coyle said he expects the change to make a significant impact on the industry since a majority of rural gathering lines around the country have remained largely unregulated until now.

“You’re going to be complying with some of these new federal safety standards that apply to the pipelines,” he said of the industry’s response to the impending new rule. “You’re going to have to provide data to the federal government about your operations and your mileage. So that’s going to be a significant change in the industry – something that might have some growing pains associated with it.”

DEP and the regulation of pipelines

Generally speaking, the Pennsylvania Department of Environmental Protection (DEP) does not regulate the pipelines themselves. However, DEP does regulate the grading and other surface disturbance of land associated with the construction of pipelines through the issuance of what is called an Erosion and Sedimentation Control General Permit (ESCGP), Lucas noted. “DEP will also be involved and may require permits if pipelines encroach on stream crossing or wetlands,” he said.

Local regulatory role and industry challenges

Local regulation of pipelines is much more limited than that of federal and state agencies. As Lucas explained, local governments are generally prohibited, the legal term is they are “preempted”, from regulating FERC-regulated pipelines and other facilities. Further “downstream”, residential and commercial service lines fall primarily within the jurisdiction of the Pennsylvania Public Utility Commission.

Municipalities do retain some jurisdiction over the “upstream” production and gathering lines connecting the gas produced at the well pads with the downstream transmission lines through their zoning ordinances and certain other ordinances. However, Lucas observed that most zoning ordinances tend to focus more on what are perceived as more impactful facilities such as well pads and compressor stations. As a result, “in most instances, local governments tend to limit their regulation of gathering lines to issuance of permits for grading and road crossings”.

In connection with FERC’s regulation of transmission lines, operators have the power of eminent domain to acquire land for necessary pipelines. However, Lucas noted that no such rights extend to operators in dealing with gathering lines. When an operator wants to connect a production line to a gathering pipeline, that operator has to obtain voluntary rights of way or easements from “dozens, if not hundreds” of property owners.

“Where that comes into play at the local level is on some of these applications – for example, on well pads, the operators will not have in place all those agreements yet, yet the local ordinances may say, ‘tell us exactly where your pipeline is going to be,’ which might not be either practical or feasible at that stage of the process.”

So-called setbacks, which are minimum distance requirements from the pipeline to the property line or an adjacent residential or commercial structure, also are becoming more restrictive and difficult to comply with at the local level, Lucas explained.

“We see those all the time,” Lucas said. “If they’re 30 or 50 feet, for example, it’s manageable. But some of those required setbacks are getting so large that they’re basically making it impossible to draw a line for a [gathering] pipeline to connect a well pad to a transmission line.”

A hopeful future

Both Coyle and Lucas remain hopeful for the energy pipeline industry, particularly in a state where natural gas continues to play such an important role in the economy.

“Pennsylvania is such an important energy state, particularly for natural gas,” Coyle concluded. “Pipelines are the primary means of transporting natural gas throughout the United States…Pipelines are the safest means for moving energy products. They’re very necessary for how we live every day, and I hope pipelines continue to be in the mix as we look toward new sources of energy because I think they make us all safer.”

Business Insights is presented by Babst Calland and the Pittsburgh Business Times. To learn more about Babst Calland and its energy practice, go to www.babstcalland.com.

For the PDF, click here.

For the full article, click here.

Energy Alert

(by Mike Winek, Gary Steinbauer, Gina Falaschi and Christina Puhnaty)

The U.S. Environmental Protection Agency (EPA) has pledged to issue, within days from now, proposed new Clean Air Act (“CAA” or “Act”) regulations for methane emissions from the oil and gas sector. EPA’s forthcoming proposal is expected to broaden the scope of its current methane requirements for new, modified, or reconstructed sources within the oil and gas sector. In addition, for the first time, EPA will propose nationwide methane emission guidelines for existing sources within the sector that individual states will be responsible for implementing. As the oil and gas sector awaits the new proposed methane requirements, this Alert summarizes the important and rare developments that have unfolded in the relatively brief history of EPA regulating methane emissions from the oil and gas sector.

Obama Administration Issues Initial Regulations of Methane Emissions from Oil and Gas Sector. EPA issued its first set of oil and gas methane-specific emission regulations in 2016 during the Obama administration. The 2016 regulations amended the then-current new source performance standards (NSPS) and promulgated new standards to directly regulate emissions of methane, as well as volatile organic compounds (VOC), from new, modified, and reconstructed equipment, processes, and activities across the entire oil and gas sector. The 2016 amendments to the NSPS were codified at 40 C.F.R. Part 60, Subpart OOOOa (Subpart OOOOa).

Subpart OOOOa included specific limits on methane emissions for new, modified, and reconstructed sources within the production and processing segments of the oil and gas sector. It also included VOC and methane standards for emission sources in the transmission and storage segments, which were previously unregulated. Subpart OOOOa did not limit aggregate methane emissions from affected facilities within the oil and gas sector. Rather, it regulated specific emissions sources used at well sites, compressor stations, and processing plants. These sources include compressors, pneumatic controllers, pneumatic pumps, well completions, storage vessels, fugitive emissions from well sites and compressor stations, and equipment leaks at natural gas processing plants. 40 C.F.R. §§ 60.5360a–60.5439a (2016). Among its various requirements, Subpart OOOOa included leak detection and repair (LDAR) requirements for fugitive emission components well sites and compressor stations and certain equipment at natural gas processing plants. 40 C.F.R. §§ 60.5397a and 60.5400a.

Trump Administration Promulgates Rule Rescinding Methane Requirements in Subpart OOOOa. EPA under the Trump administration finalized amendments to Subpart OOOOa on September 14, 2020, which were referred to as the “Policy Amendments.” Oil and Natural Gas Sector: Emission Standards for New, Reconstructed, and Modified Sources Review, 85 Fed. Reg. 57,018 (Sep. 14, 2020). After removing the transmission and storage segment from the NSPS for the oil and gas sector, the Policy Amendments rescinded the methane-specific requirements in Subpart OOOOa that applied to the production and processing segments, leaving only VOC-specific requirements for affected sources within the production and processing segments.

One day after promulgating the Policy Amendments, EPA issued a companion regulation known as the “Technical Amendments,” which revised certain remaining VOC-only requirements in Subpart OOOOa for the production and processing segments. Oil and Natural Gas Sector: Emission Standards for New, Reconstructed, and Modified Sources Reconsideration, 85 Fed. Reg. 57,398 (Sep. 15, 2020).

Congress Intervenes to Restore Methane Requirements in Subpart OOOOa. On June 30, 2021, President Biden signed into law a joint congressional resolution disapproving of the Policy Amendments rule. The resolution was issued under the Congressional Review Act (CRA), a statute granting Congress the time-limited authority to rescind administrative rules based on a simple-majority vote in both the Senate and the House of Representatives and signature by the president. The CRA resolution retroactively revoked the Policy Amendments rule, restoring the Obama administration’s NSPS for the oil and gas sector, including the methane-specific requirements of Subpart OOOOa.

More specifically, the CRA resolution, among other things, restored the Subpart OOOOa methane-specific requirements for sources in the production, processing, and transmission and storage segments that commenced construction, reconstruction, or modification after September 18, 2015. Because the Technical Amendments rule was unaffected by the CRA resolution, the VOC-only requirements contained therein remain in effect. From a legal standpoint, the CRA resolution means that affected sources within the production and processing segments, at least temporarily, have different technical requirements related methane and VOC emissions.

Looking Ahead to Proposed New Methane Requirements for the Oil and Gas Sector. EPA’s Acting Assistant Administrator for the Office of Air and Radiation has indicated that EPA will propose “updated” and “upgraded” rules for new, modified, and reconstructed emissions sources currently regulated under Subpart OOOOa. In addition, EPA will be proposing to significantly expand the scope of existing federal oil and gas methane regulations to include emissions guidelines for existing sources that are not regulated under Subpart OOOOa (unless and until the existing sources are modified or reconstructed).

Babst Calland is closely tracking EPA’s efforts to propose new methane requirements for the oil and gas sector. Regulated parties would be well-advised to prepare now to review, evaluate, and consider commenting on EPA’s proposed new methane requirements. If you have questions about Subpart OOOOa or the forthcoming new proposed methane requirements for the oil and gas sector, please contact Michael H. Winek at (412) 394-6538 or mwinek@babstcalland.com, Gary E. Steinbauer at (412) 394-6590 or gsteinbauer@babstcalland.com, Gina N. Falaschi at (202) 853-3483 or gfalaschi@babstcalland.com, or Christina Puhnaty at (412) 394-6514 or cpuhnaty@babstcalland.com.

Click here for PDF.

Energy Alert

(by Kevin Garber, Sean McGovern and Jean Mosites)

On September 14, 2021, the Sierra Club, PennFuture, Clean Air Council, Earthworks and other groups (Petitioners) submitted two parallel rulemaking petitions to Pennsylvania’s Department of Environmental Protection (DEP) asking the Environmental Quality Board (EQB) to require full-cost bonding for conventional and unconventional oil and gas wells, for both new and existing wells. The petitions do not address or consider the permit surcharges and other funding mechanisms for plugging wells, including the federal infrastructure bill that is expected to provide millions of dollars to plug abandoned wells.

Background

The Pennsylvania General Assembly addressed and increased bonding in 2012. Under Act 13, well owners/operators are required to file a bond for each well they operate or a blanket bond for multiple wells. Currently, the bond amount for conventional wells is $2,500 per well, with the option to post a $25,000 blanket bond for multiple wells. 72. P.S. §1606-E. For unconventional wells, the current bond amount required varies by the total well bore length and the number of wells, and is limited under the statute to a maximum of $600,000 for more than 150 wells with a total well bore length of at least 6,000 feet. 58 Pa.C.S. §3225(a)(1)(ii). EQB has statutory authority to adjust these amounts every two years to reflect the projected costs to the Commonwealth of plugging the well.

Proposed Changes to Bond Amounts

The Petitioners contend that a lack of full-cost bonding has resulted in the abandonment of thousands of wells and that such wells pollute the environment and adversely affect the health of communities, and allege that the EQB has an obligation to increase bond amounts pursuant to the petition under the Environmental Rights Amendment. Pa. Const. art. I, § 27. Petitioners argue that increased bond amounts would encourage operators to plug non-producing wells or provide funds for the state to plug wells if an operator does not plug them.

The Petitioners rely upon the EQB’s authority to adjust a well’s bond “every two years to reflect the projected costs to the Commonwealth of plugging the well” (58 Pa.C.S. § 3225(a)) to propose a dramatic increase in bond amounts, applying the increases retroactively.

Petition for Full-Cost Bonding for Conventional Wells

The petition for conventional well bonding seeks to amend 25 Pa. Code § 78.302.

The petition requests the bond increase from $2,500 to $38,000 per well and the blanket bond increase from $25,000 to the sum of the applicable individual bond or security amount required for each well. For example, a blanket bond for 10 wells at $38,000 per well would total $380,000. The Petitioners contend that the proposed bond amount is supported by an expert analysis of average well plugging costs from 1989 to 2020. The expert report concludes that the bond should be raised to $25,000 and $70,000, for conventional and unconventional wells respectively. The Petition notes, however, that $38,000 is in line with DEP’s estimate of $33,000 for its average historical cost of plugging abandoned/orphaned conventional wells.

The amendment requested would apply to new as well as existing wells drilled after April 17, 1985. The amendment also would require DEP to report to EQB every two years (four years, if two is not feasible) whether EQB should adjust the bond amount.

Petition for Full-Cost Bonding for Unconventional Wells

The petition asks EQB to adopt a new regulation for unconventional wells in 25 Pa. Code Chapter 78, which would mirror an amended regulation for conventional wells, even though 25 Pa. Code § 78a.302 already exists and would contradict the proposed new regulation.

The Petitioners want EQB to increase the bond from the current range, which starts at $4,000 per well, to $83,000 per unconventional well. Blanket bonds would equal the sum of the applicable individual bond or security amount required for each well. For example, a blanket bond for 10 wells at $83,000 per well would total $830,000. The Petitioners rely on substantially the same analysis and rationale used in their petition for conventional wells to support the increased bond amounts.

Like the petition for conventional wells, the regulation would apply to new and existing unconventional wells drilled after April 17, 1985 and would require DEP to report to EQB every two years (four years, if two is not feasible) whether EQB should adjust bond amounts.

What happens next?

Per the EQB Petition Policy, as set forth in the regulations at 25 Pa. Code Chapter 23, DEP has 30 days from receipt of the petitions to determine whether the petitions are complete and if they request an action that can be taken by the EQB that does not conflict with federal law. If the DEP determines the petitions meet the above conditions, the EQB will be informed of the petition for rulemaking and the nature of the request. At the next EQB meeting occurring at least 15 days after the Department’s determination, the Petitioners may make a brief oral presentation and DEP will make a recommendation whether the EQB should accept the petition.

Babst Calland will be tracking these petitions and subsequent actions taken by DEP and the EQB. If you have any questions regarding the potential regulatory changes described in this Alert, please contact Kevin Garber at (412) 394-5404 or kgarber@babstcalland.com; Sean McGovern at (412) 394-5439 or smcgovern@babstcalland.com; or Jean Mosites at (412) 394-6468 or jmosites@babstcalland.com.

Click here for PDF.

Energy Alert

The United States District Court for the Northern District of West Virginia has certified questions to the West Virginia Supreme Court of Appeals asking whether the seminal decision in Estate of Tawney v. Columbia Natural Resources, LLC, 219 W.Va. 266, 633 S.E.2d 22 (2006) regarding the deductibility of post-production expenses remains the law of West Virginia, and if so, the proper interpretation of Tawney.

In Charles Kellam, et al. v. SWN Production Company, LLC, et al., No. 5:20-CV-85, a class action royalty case, the District Court, Judge John Preston Bailey, certified on his own motion whether Tawney remains the law of West Virginia, whether the lease in question allowed the deductions, and the proper application of Tawney. The District Court certified the questions without ruling on the defendants’ pending Motion for Judgment on the Pleadings which argued the Kellam’s lease complied with Tawney and the District Court was bound by the decision in Young v. Equinor USA Onshore Properties, Inc., 982 F.3d 201 (4th Cir. 2020), where the Fourth Circuit Court of Appeals reversed Judge Bailey and held a similar lease clearly and unambiguously allowed the deduction of post-production expenses. The Kellam’s lease states the lessee agrees to pay the lessor “as royalty for the oil, gas, and/or coalbed methane gas marketed and used off the premises and produced from each well drilled thereon, the sum of one-eighth (1/8) of the price paid to Lessee per thousand cubic feet of such oil, gas, and/or coalbed methane gas so marketed and used . . . less any charges for transportation, dehydration and compression paid by Lessee to deliver the oil, gas, and/or coalbed methane gas for sale.”

In Young, the Fourth Circuit Court of Appeals rejected the finding by Judge Bailey that the lease did not contain sufficiently explicit language about the method of calculating deductions and therefore did not comply with Tawney, noting that “Tawney doesn’t demand that an oil and gas lease set out an Einsteinian proof for calculating post-production costs. By its plain language, the case merely requires that an oil and gas lease that expressly allocates some post-production costs to the lessor identify which costs and how much of those costs will be deducted from the lessor’s royalties.” Young, 982 F.3d at 208.

In the September 14, 2021 Order certifying the questions to the West Virginia Supreme Court of Appeals, Judge Bailey relied on his similar reasoning in Young, which the Fourth Circuit Court of Appeals rejected.

The West Virginia Supreme Court of Appeals may reformulate the questions and will decide whether to accept the certified questions for review. If they do, a briefing schedule will be entered, and the court will also decide whether to allow limited or full oral argument.

For more information about the case contact Tim Miller, tmiller@babstcalland.com, Jennifer Hicks, jhicks@babstcalland.com, or Katrina Bowers, kbowers@babstcalland.com, who are serving as counsel for the defendants in Kellam.

Click here for PDF.

Pipeline Safety Alert

(by James Curry and Evan Baylor)

If enacted, the Senate Infrastructure Investment and Jobs Act of 20211 (Infrastructure Bill) would provide $1 billion for the newly established Natural Gas Distribution Infrastructure Safety and Modernization Grant Program (Program) to be administered by the Pipeline and Hazardous Materials Safety Administration (PHMSA). The program would offer $200 million in grant funding each year for five years, starting in fiscal year 2022. The funding would be available only to municipal and community owned utilities. Eligible projects would include the repair, rehabilitation, or replacement of natural gas distribution pipeline systems and the acquisition of equipment to improve pipeline safety and avoid economic losses. In choosing projects, PHMSA would consider: (1) the risk profile of applicant’s current pipeline systems, including if they are prone to leaks; (2) whether a project may generate jobs; (3) whether a project may benefit disadvantaged communities; and (4) and how a project would impact economic growth.

If enacted, the $1 billion Program would reflect a substantial expansion of PHMSA’s current grant programs both in terms of the amount of funding available and because it would authorize spending on capital projects.

Given the scope of this program, if it is adopted into law, stakeholders may have practical questions on how PHMSA would implement it. For example, would capital projects funded through the Program trigger NEPA? Or would a Categorical Exclusion apply? Current DOT Categorical Exclusions may not cover projects and PHMSA does not have its own set of Categorical Exclusions.2 Would PHMSA need to propose implementing regulations for the Program or could it adopt a less formal application process and criteria? How would PHMSA choose projects, given the broad criteria outlined in the Infrastructure Bill? And would PHMSA limit projects to only physical infrastructure or could projects also include technology, software, and cybersecurity improvements? Further, would PHMSA have sufficient current staffing to administer the Program?

The Infrastructure Bill is not yet enacted. It still requires passage in the House before it would move to President Biden’s desk.

If you have any questions or would like further information regarding the proposed Natural Gas Distribution Infrastructure Safety and Modernization Grant Program, please contact Jim Curry at 202.853.3461 or jcurry@babstcalland.com.

Click here for PDF.

_________________________

1 H.R.3684 – 117th Congress (2021-2022): Infrastructure Investment and Jobs Act, H.R.3684, 117th Cong. (2021), https://www.congress.gov/bill/117th-congress/house-bill/3684.